I ve tried to attach a few simple chart examples to better illustrate the point.

Average true range indicator formula.

Even so the remnants of these first two calculations linger to slightly affect subsequent atr values.

As the indicator s mathematical formula suggests average true range cannot be used for trading signals on its own.

While this indicator was developed years before online trading it remains popular and useful to this day.

This indicator is developed by j.

The average true range indicator is an oscillator meaning the atr will oscillate between peaks and valleys.

Standard average true range indicator from the metatrader 5 trading platform with period set to 14 is used for calculation.

The first true range value is simply the current high minus the current low and the first atr is an average of the first 14 true range values.

The other element of the atr is the indicator is based on the price performance of the stock in question.

Average true range atr is a volatility indicator that shows how much an asset moves on average during a given time frame.

Average true range atr is a technical analysis volatility indicator originally developed by j.

Welles wilder and shared in his 1978 book new concepts in technical trading systems stockcharts n d.

Atr is showing neither trend s strength nor its direction.

What is the average true range indicator.

The average true range is an n period smoothed moving average smma of the true range values.

In plain english the atr formula multiplies the previous fourteen days average true ranges by thirteen.

1 the atr has no upper or lower limit bounds like the rsi or slow stochastics.

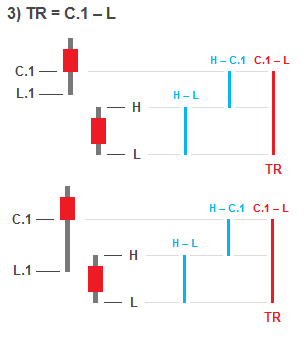

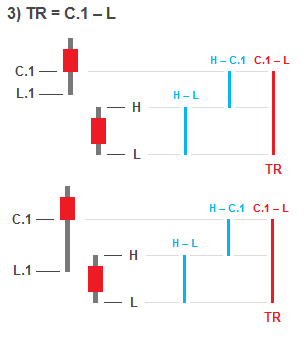

The formula is quite simple true range is the greatest of the following three price differences.

Before atr itself we must first calculate true range for each day because atr is a moving average of that.

It is typically derived from the 14 day moving average of a series of true range indicators.

The indicator does not provide an indication of price trend simply the degree of price volatility.

Finally it divides the outcome by fourteen.

Next it adds the most recent trading day s true range.

Wilder recommended a 14 period smoothing.

The concept of true range and calculation of atr average true range is confusing for many people as you are actually comparing three values instead of applying one exact formula.

This page is a detailed guide to calculation of true range.

Average true range atr is a technical indicator measuring market volatility.

High minus low the traditional range high minus previous close.

Atr prior atr 13 current true range 14.